|

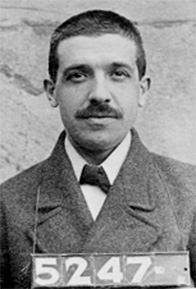

"...in 1920, Ponzi's sham firm in Boston collected an estimated $10 million from hopeful investors who had been drawn in by his pledge to pay a 50 percent return on the money via the selling of overseas postal reply coupons. The savvy con artist, who targeted Boston's Italian American community and other working-class folk, merely paid his first round of investors with funds deposited by newcomers." More... SOURCE: Charles Ponzi. (2014). In Encyclopedia of World Biography (Vol. 34). Detroit: Gale. |

Source:Wikipedia Commons |

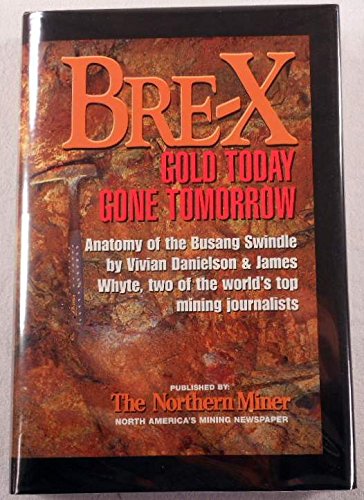

"One of the worst scandals ever experienced in the securities markets occurred in 1997 when it was discovered that claims of an unprecedented gold find in Indonesia by a Canadian company known as Bre-X were fraudulent. Ore samples had been salted. The Bre-X stock had soared to $4.5 billion in value before exposure of this hoax. The company’s mining engineer mysteriously disappeared while flying in a helicopter over the site." More...

SOURCE: "4 The Market Boom." A Financial History of the United States, Jerry W. Markham, Routledge, 1st edition, 2002.

"The scandal resulted in a wave of new regulations and legislation designed to increase the accuracy of financial reporting for publicly traded companies. The most important of those measures, the Sarbanes-Oxley Act (2002), imposed harsh penalties for destroying, altering, or fabricating financial records." More...

"The scandal resulted in a wave of new regulations and legislation designed to increase the accuracy of financial reporting for publicly traded companies. The most important of those measures, the Sarbanes-Oxley Act (2002), imposed harsh penalties for destroying, altering, or fabricating financial records." More...

SOURCE: Enron scandal. (2017). In Encyclopædia Britannica.

"The Madoff scandal was a fraudulent investment scheme, exposed in 2008, that was perpetrated over a number of years by Wall Street financier and former NASDAQ chairman Bernard Madoff. It was an elaborate, high-stakes Ponzi scheme in which current investors were paid returns on their investments from the funds invested by new investors rather than from actual market gains." More...

SOURCE: Ciment, J. (2013). Madoff (Bernard), scandal. In R. Chapman, & J. Ciment (Eds.), Culture wars in America: An encyclopedia of issues, viewpoints, and voices (2nd ed.). London, UK: Routledge.

Understanding Ponzi Schemes: can better financial regulation prevent investors for being defrauded? [E-Book]

A Ponzi scheme is one of the simplest, albeit effective, financial frauds to engineer, and new schemes keep coming forward. Despite this, however, people continue to invest in them. How are we to account for the seemingly never-ending lure of such schemes? In providing answers to this central question, this concise and well-researched book examines how Ponzi schemes operate, and how they differ from pyramid schemes, Ponzi finance and other financial arrangements.

Understanding Ponzi Schemes: can better financial regulation prevent investors for being defrauded? [E-Book]

A Ponzi scheme is one of the simplest, albeit effective, financial frauds to engineer, and new schemes keep coming forward. Despite this, however, people continue to invest in them. How are we to account for the seemingly never-ending lure of such schemes? In providing answers to this central question, this concise and well-researched book examines how Ponzi schemes operate, and how they differ from pyramid schemes, Ponzi finance and other financial arrangements.

Bre-X : gold today, gone tomorrow ; anatomy of the Busang swindle

Bre-X : gold today, gone tomorrow ; anatomy of the Busang swindle